Key takeaways

eCheck Payments

An eCheck is a check that can be written and accepted 100% online. Like a paper check, an eCheck allows a business to withdraw the amount directly from the payer’s checking account.

More and more clients expect convenience payment options for all services, including legal, which is why an increasing number of law firms today are embracing electronic payments. When implemented intelligently, these payment methods can significantly simplify things for your team and your clientele. However, with so many digital payment methods out there, it can be hard for law firms to know which ones are best for them and their clients.

Electronic checks (a.k.a. eChecks) allow law firms to offer their clients a straightforward digital payment method without the inconvenience and risk of handling paper checks.

Adding eCheck payments is a great way for legal professionals to modernize the client payment experience, streamline their accounting processes, and appease clients who still prefer to work with checks. But how do electronic checks work? What’s the difference between an eCheck, a direct deposit, and a wire transfer? How do you start accepting eCheck payments?

In this article, we’ll provide a comprehensive overview of eCheck technology, how it works, and the advantages of utilizing it for legal payments.

What Is an eCheck?

An eCheck is a check that can be written and accepted 100% online. Like a paper check, an eCheck allows a business to withdraw the amount directly from the payer’s checking account by using a client’s:

Checking account number

Bank routing number

Payment amount

An eCheck is also known as a “pull payment” in that the business (or the law firm) initiates the payment and “pulls” it from the client’s account. This differs from a direct deposit, where the buyer (or client) initiates the deposit and “pushes” money into another account.

At first glance, eChecks can seem confusing because there are many different terms used to describe the same thing. All of the terms below are synonymous with eCheck:

Online check

Internet check

Direct debit

eCheck Payments vs. Wire Transfers

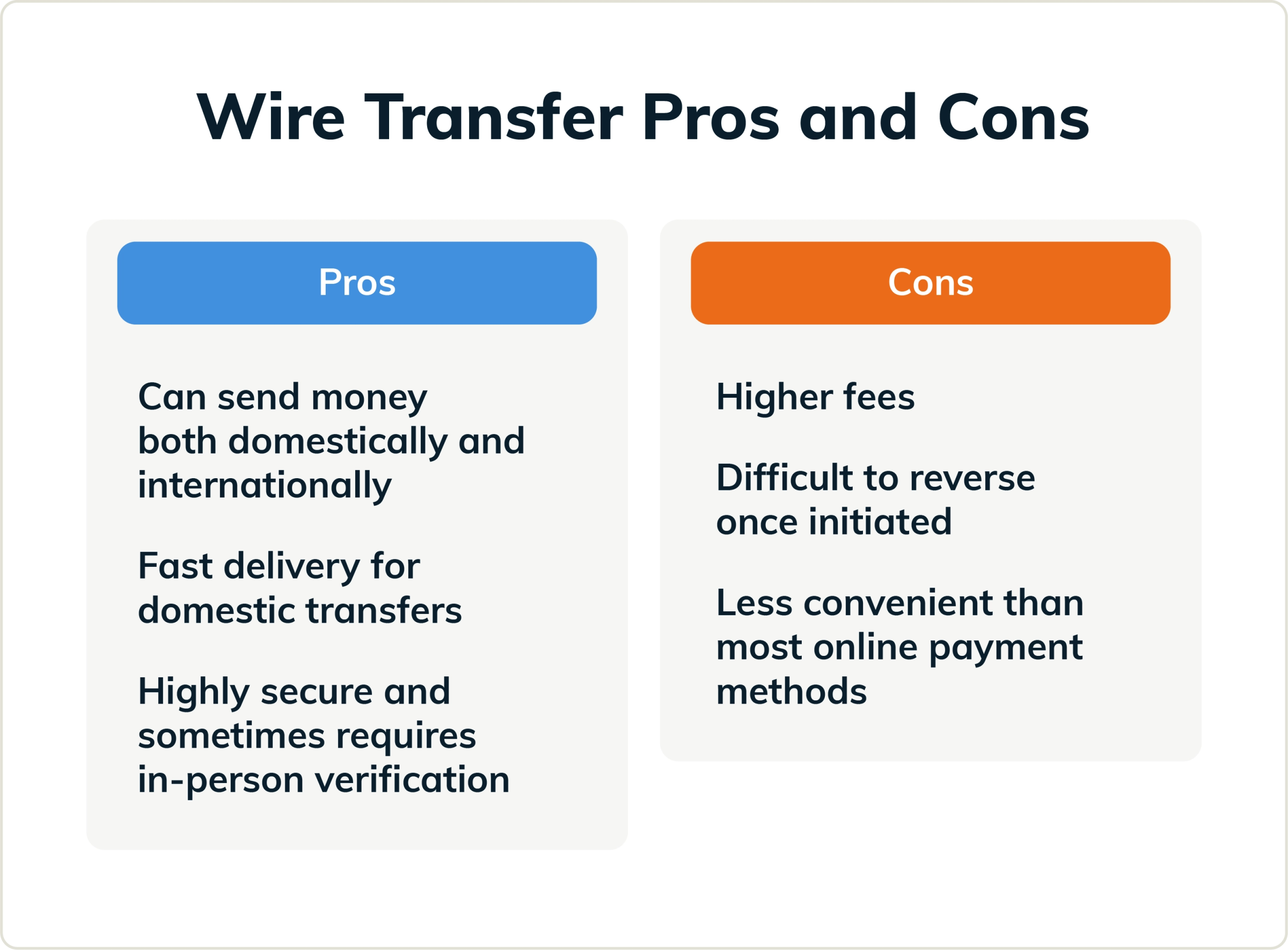

While wire transfers and eChecks are both ways to move money between bank accounts, there are a few key differences between them. First, a wire transfer is a method of sending money directly between banks or credit unions. They are often used for cross-border or sensitive transactions because they are handled directly by the bank and are done one at a time, usually for a fairly substantive fee.

On the other hand, eChecks are processed in batches by the ACH, making them less labor-intensive. Second, like a paper check, payment on an eCheck can be canceled, whereas a wire transfer can’t be stopped once it’s initiated.

That said, the additional security of a wire transfer comes with some noted drawbacks, mainly in speed and cost. With wire transfers, consider:

eCheck Payments vs. ACH Payments

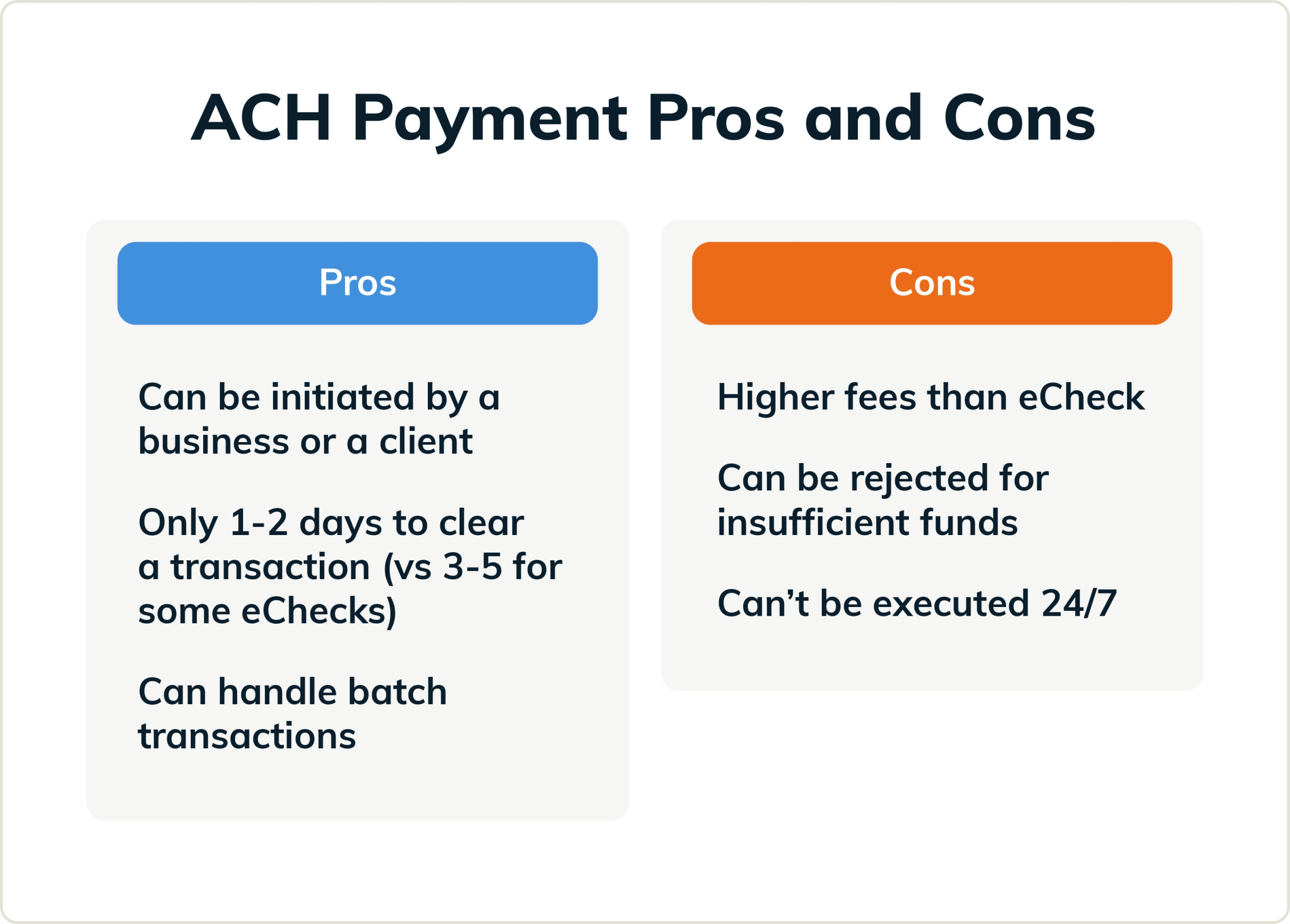

Many digital payments, including eChecks, are processed by the ACH (Automated Clearing House) Network, a network used by participating financial institutions and businesses. ACH transfers are used to make a wide variety of direct payments - pretty much anytime you pay for something without putting in a credit card number or writing a paper check, it’s using the ACH.

Though primarily used for online payments now, the ACH was created in the late 1960s to streamline the handling of electronic payments. Now, eCheck payment processing and ACH payments are a ubiquitous form of online payment for a wide range of industries.

It is worth noting that ACH payments and eChecks are not synonymous. Put another way, all eChecks are a form of ACH transfer, but not all ACH transfers are eChecks. With ACH payments, you can expect:

How do eChecks Work?

The process to accept eCheck payments is almost identical to the one used for paper checks, with speed and security being the biggest differentiators. Handling check payments electronically reduces the processing and hold times, making funds available faster. Also, since there is no paper record to intercept, and payment processors use secure forms, the client’s information is better protected.

Actual eCheck processing times can vary based on factors like what time of day it was sent, the payment provider, and whether the business account is new or not. The average processing time for an eCheck is three to five days, but it can be as little as 24 to 48 hours in some cases.

Here are the steps that go into processing an electronic check:

1. Authorization Request: First, the client must authorize electronic payment via a signed form, over the phone, or using a secure online form.

2. Payment Information and Setup: Using a payment processing solution, the firm enters the details of the payment. Payments can be set up to be one-time or recurring.

3. Finalize and Submit: Once the details are confirmed, the payment is submitted and then processed through the ACH. Funds typically take three to five business days to transfer, but some solutions allow limited next-day fund availability.

To maintain legal trust and IOLTA compliance, funds will need to be put into specific accounts depending on the type of payment being made. Luckily, legal e-billing software can streamline this process and significantly lower the risk of making an error.

Are eChecks Safe?

Some clients may ask: Are eChecks safe? In short, yes, eChecks are just as secure as any other digital payment. Though all electronic payment methods carry some inherent risks that law firms should be aware of.

The primary source of electronic check fraud is when a threat actor gains access to previous invoices or sensitive client information through a data breach. They could then use this information to initiate a payment to their own account. Unlike a paper check, there’s no physical verification of signatures or ID checks involved, making this information sufficient to make a fraudulent payment.

To avoid this nightmare scenario, law firms that offer eCheck payments must invest in a fully compliant and secure online payment solution. In other words, the important question isn’t necessarily, “Are eChecks safe?” but rather, “Is my payment solution safe?”

If you’re considering adding eChecks to your list of alternative payment methods, look for payment software that at a minimum is:

Encrypted: Ensure all sensitive information is encrypted during the payment process itself.

Secure: Check to see if your solution uses payment portals that are fully compliant with the latest data security standards.

Legally Compliant: Avoid ethical quagmires by ensuring your eCheck payments meet IOLTA and jurisdiction-specific requirements.

That said, eChecks are an inherently safer option than paper checks and are considered a highly safe payment method. When all eCheck transactions are handled online through secure online payment software, there are no opportunities for criminals to steal account information or make alterations during the process itself. All sensitive data is encrypted, and the client’s accounting and routing numbers are also verified with each transaction to ensure accuracy and proper ownership.

Why Should Your Firm Accept Electronic Checks?

Offering digital legal payments is an important step for law firms looking to meet modern client expectations. Like mobile payments and other digital payment methods, eChecks provide clients a simplified way to pay for retainers and other legal fees. eCheck payments for law firms provide a number of unique benefits.

Increases Revenue and Efficiency

Online checks offer a number of financial benefits over paper checks and even other legal electronic payment methods. First and foremost, eCheck payments incur much lower processing fees compared to credit cards and many 3rd party payment processors. Since payment processing fees must be covered by the firm’s operating account and not the clients, those expenses can add up quite a bit over time. Accepting eCheck payments for large sums can also save a great deal of money on individual payments as well.

In addition to the lower fees, eChecks also save law firms time in a few crucial ways. Most obviously, with electronic checks, accounting teams do not need to spend extra time manually logging and depositing checks. But better yet, compared to paper checks, eChecks have shorter processing and hold times, which means you’ll have money available faster.

Maximizes Payment Security and Compliance

One of the top benefits of eCheck payments is how much safer they are than paper checks. Simply by handling paper checks (or even old-school paper banking forms), your firm’s privacy and security risk increases exponentially. Clients still have to mail or otherwise physically deliver the check to your office, and this can create opportunities for it to be stolen in transit. Before a paper check is deposited in a bank, it provides a treasure trove of sensitive information for criminals and fraudsters. Physical checks can also be altered or tampered with in ways that eChecks can’t.

Are eCheck payments as secure as credit cards? It depends on who you ask. Many of the inherent risks of eChecks are based more on the payment service than the method of payment itself.

Several eCheck payment solutions also allow firms to add an extra layer of security, such as making clients log into a secure portal account. Ultimately, while credit cards and eChecks use different security protocols, both are considered highly safe, with only minor differences.

In addition to traditional security concerns, paying with eCheck can also help reduce legal compliance risk. Compared with paper checks, eChecks are much easier to log, and legal accounting software can ensure that funds are handled correctly.

Makes Payment More Convenient for Clients

Why wait for your clients to write a check, stamp it, and send it by mail? Instead, they can easily type their bank information into a secure payment portal and send payment with a simple click of a button.

Not only is this more convenient for them, it takes the mystery out of whether their payment is heading your way—you’ll be able to see right away that their check payment is being processed. This not only causes fewer headaches for you, but it also helps you meet changing consumer expectations. A recent study found that over 60% of consumers wanted faster ways of seeing payments they’ve initiated.

Using eChecks also enables you and your clients to easily set up recurring attorney payment schedules. You and your client can arrange to have funds debited from their account at specific intervals—once a week, twice a month, or until a dollar amount has been reached. This makes the process more convenient and is an easy way to increase client satisfaction.

Reduces Reliance on Paper

The rising use of digital payments also presents an opportunity for offices to reduce paper waste. Switching to digital payments, including eChecks, is a fantastic step towards transitioning to a completely paperless practice.

Of course, being environmentally friendly isn’t the only benefit of accepting eCheck payments. Less paper means less manual data entry and time spent physically tracking down information, which translates into significant cost and time savings.

Modern digital payment solutions can also automatically handle things like payment requests and receipts via email. Making the switch to digital payment is a win-win, both in streamlining your day-to-day tasks and for the environment.

Best Practices of eCheck Payments for Law Firms

If you are interested in accepting eCheck payments at your law firm, consider the following important factors:

Establish Transparent Billing With Clients

Offering a variety of payment methods helps create a more client-centric experience and removes barriers to making on-time payments. However, the more you expand digital payments, the more important it is to clearly communicate your billing processes.

Ensure clients know all of their payment options upfront and include reminders when sending electronic invoices. For recurring eCheck payments, clearly communicate when and how payments will be collected. To reduce any potential confusion, it might also be beneficial to create a step-by-step guide on how to pay by e-check.

Last, some clients erroneously view certain electronic methods as less secure than others. Creating an FAQ page to address common questions and concerns around your various payment methods can help put clients at ease.

Ensure IOLTA and Trust Accounting Compliance

While offering multiple payment methods, including electronic checks, makes getting paid easier, it can also open your firm up to risk if it’s not done carefully. Many third-party payment services are not designed to avoid commingling operating and client funds, along with any jurisdiction-specific financial requirements.

In other words, the benefits of eCheck payments could be completely negated if they are not backed by a legally compliant solution.

It’s essential to use industry-specific payment software when offering new digital payment methods—these solutions are designed out of the box to maintain IOLTA compliance. There’s no need to set up any complex accounting integrations to get a new payment method up and running.

Additionally, many leading legal payment software providers are not limited to a single payment type. This allows firms to accept eCheck payments, digital wallets, credit card payments, and other common payment methods within a single system, drastically simplifying reconciliation and financial tracking.

Accurately Track and Monitor Payments

A consolidated system for all payments (including eChecks) not only simplifies financial forecasting and account reconciliation but also gives you valuable insights into client preferences and the overall payment experience.

A unified payment system can track the effectiveness of eCheck payments compared to other payment methods. For example, if you notice that clients start with eCheck payments and then switch to another payment method, it could indicate that part of the eCheck payment process is confusing or cumbersome.

Understanding the friction points when paying with an eCheck can help you improve the eCheck payment process. Because eChecks generally have lower processing fees than credit cards, this could lead to better cash flow for your firm.

How Can Law Firms Start Accepting eCheck Payments?

To start accepting electronic checks at your firm, you first need to sign up for an ACH or eCheck merchant account. Your business will need to provide the following information:

The firm’s name and address

The federal tax ID number

How long has the business been in operation

Estimated transaction volume

Bank information

Signing up is simple, and approval generally only takes a few days. This setup process can also be done through your digital payment provider. Once approved, trusted technology partners like LawPay can then set up a payment portal or other secure form to send to your clients.

Note: The first few ACH transfers with a new account may take slightly longer than usual; however, this will speed up after only a few successful transactions.

Easily Process eCheck Payments With LawPay

Legal payment technology makes it easier than ever for law firms to accept online check and card payments. LawPay’s proprietary eCheck payment processing solution is simple to use and fully compliant with IOLTA rules, ensuring you never commingle earned and unearned funds.

Having the right tools to handle eCheck and other digital payments is all the more essential for independent attorneys or smaller firms that can’t afford a dedicated accounting team. In addition to providing convenient digital and credit card payment options for clients, LawPay simplifies your billing and payment processes with:

Flexible Legal Fee Financing: Offer clients flexible options like legal fee funding, which allows clients to pay in installments over time while your firm gets paid upfront and in full.

Streamlined Time Tracking: Easily track time and expenses for more accurate invoices and better billing transparency.

Comprehensive Billing and Invoicing: Access all of your firm’s billing, invoicing, payment, and expense tracking in a single, easy-to-use platform.

Even firms that specialize in highly scrutinized financial areas like tax law, commercial banking law, and insurance rely on LawPay to meet evolving client expectations. Diana Cupps, founder of Diana the Lawyer, notes, “By offering a diverse array of payment options, such as eCheck and credit card payments, the firm demonstrates its commitment to accommodating client needs with utmost convenience and flexibility.”

Schedule a demo with one of our legal payment experts today to see how implementing eChecks and other digital payment methods can improve the client experience and help you get paid faster.

Schedule a demo to see what LawPay can offer your firm.

Get a demo

About the author

The LawPay Team